The news broke on October 22nd, 2022. Elon Musk bought Twitter for US$ 44 billion at US$ 54.20 per share. Was it a good deal? Analysts can use different methods to assess a public company valuation: market-based, tangible book value, liquidation methods, break-up value, replacement cost methods, or discounted free cash flow valuation.

We use two methods to assess Twitter’s valuation: the comparable companies’ market-based method and the discounted free cash flow valuation method.

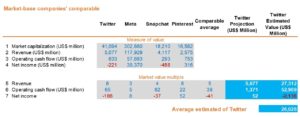

Market based-method: Comparable companies’

We found three companies that we believe are comparable to the target company: Twitter, Meta, Snapchat, and Pinterest.

Twitter is a global platform for public self-expression and conversation in real-time so people can consume, create, distribute and discover content about the topics and events they care about most. Through Topics, Interests, and Trends, Twitter helps people find out what’s happening through text, images, on-demand and live video, audio from people, content partners, media organizations, advertisers, and others. In addition, media outlets, websites, and Twitter’s partners extend the reach of Twitter content by distributing Tweets beyond the app and website (Twitter Annual Report 2021).

Meta gives people the power to build community and bring the world closer together. All of our products, including our apps, share the vision of helping to bring the metaverse to life. The company builds technology that helps people connect, find communities, and grow businesses. Meta-engaging products enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality (VR) headsets, wearables, and in-home devices. The company also helps people to discover and learn about what is going on in the world around them, enables people to share their opinions, ideas, photos and videos, and other activities with audiences ranging from their closest family members and friends to the public at large, and stay connected everywhere by accessing its products. Meta is moving beyond 2D screens toward immersive experiences like augmented and virtual reality to help build the metaverse, which the company believes is the next evolution in social technology. Meta incorporates Facebook, Instagram, Messenger, and WhatsApp (Meta Annual Report 2021)

Snap Inc. is a camera company and believes that reinventing the camera represents the most significant opportunity to improve how people live and communicate. The flagship product, Snapchat, is a camera application that helps people share visually with friends and family through short videos and images called Snaps. The company empowers users to express themselves instantly by opening directly to the camera. In addition, snaps are deleted by default, so there is less pressure to look pretty or perfect when creating and sending images on Snapchat. (Snapchat Annual Report 2021).

Pinterest is where over 400 million people get inspired to live their best lives. They come to discover and bring to life ideas for their daily activities like cooking dinner or deciding what to wear; for significant commitments like remodeling a house or training for a marathon; for ongoing passions like gardening or fashion; and for milestone events like planning a wedding or a dream vacation. Users or Pinners often don’t have the words to describe what they want, but they know when they see it. Likewise, images and videos can communicate concepts that are impossible to describe with words (Pinterest Annual Report 2021).

We selected three indicators of the measure of value: revenue, operating cash flow, and net income. First, the market value for each company is given in row 1. Next, we detail the dollar value of each measurement in rows 2 to 4 and provide the market value multiples in rows 5 to 7.

We assessed Twitter’s valuation at US$ 26 billion using the market-based method.

Market based-method: comparable companies

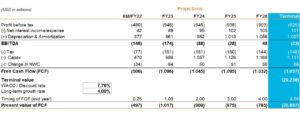

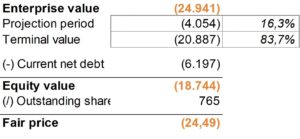

Discounted Free Cash Flow Valuation

We created a forecast using the data from Twitter’s annual report year 2017 to 2021 that we described in our previous blog (Twitter: was the purchase a good deal?). We estimated the WACC, the terminal value, net working capital, CAPEX, the free cash flow, and the enterprise value.

We assessed Twitter’s valuation at US$ -21 billion using discounted free cash flow valuation.

Discounted Free Cash Flow Valuation

Final Thought

The market-based method shows us that Twitter has a value of US$26 billion, while the discounted free cash flow valuation is negative at US$21 billion, with no value at all. Furthermore, this calculation did not include the potential loss of income that Twitter probably lost in the week after the acquisition, when some big advertisers stopped advertising on the platform. Moreover, the forecast does not include decreased, or increased expenses due to the payroll downsize. So, finally, Was it a good deal?

Ps. We use a template from https://valueinvesting.io/ to calculate the discounted free cash flow valuation.